How to Prepare for a Business Audit: Best Practices for Success

Introduction: Why Preparing for a Business Audit Is Crucial

When it comes to business audits, preparation is key. A business audit, while critical, can seem like a daunting process. However, by taking proactive steps, you can ensure that your business is well-prepared, efficient, and able to handle the review process smoothly. Whether it’s a financial audit, operational audit, or a comprehensive full-scale audit, being prepared can significantly reduce stress and increase the audit’s value for your company.

In this article, we’ll walk through the essential steps for preparing for a business audit, from organizing your records to understanding the scope of the audit and working with auditors to ensure a smooth process.

1. Understand the Audit Process and Scope

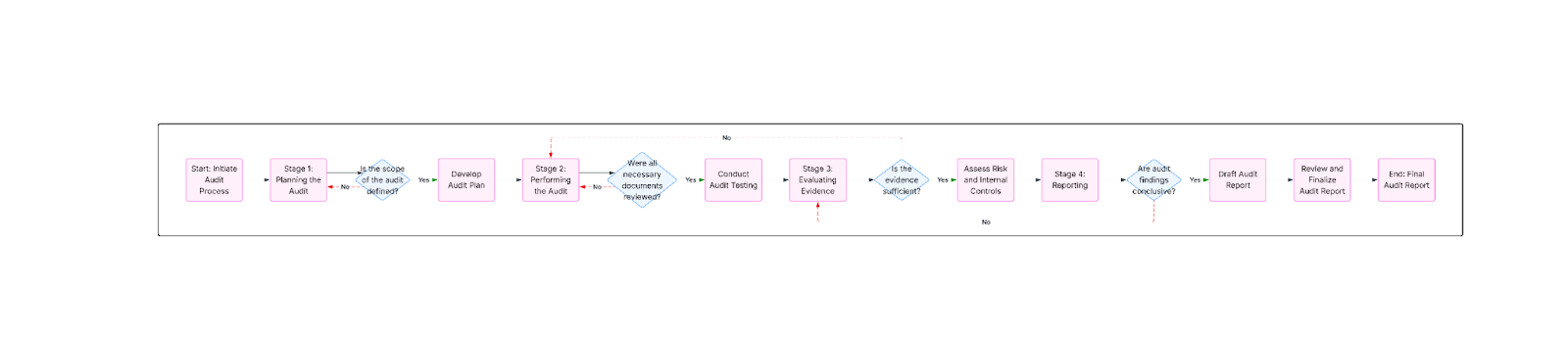

Before diving into preparation, it’s essential to understand the audit process itself. Audits come in various forms, including financial audits, compliance audits, and operational audits. Each type of audit focuses on different aspects of your business.

- Financial Audit: Reviews your financial statements to ensure accuracy and compliance with accounting standards.

- Compliance Audit: Assesses whether your business is adhering to relevant laws, regulations, and industry standards.

- Operational Audit: Evaluates your internal processes, resources, and efficiency to identify areas of improvement.

By understanding the type of audit, you can tailor your preparation efforts to meet the specific needs of the review.

2. Organize Financial and Operational Records

One of the most important tasks in audit preparation is ensuring that all your financial and operational records are organized and up-to-date. Auditors will examine your company’s financial statements, tax filings, invoices, and contracts. Here’s how to organize them:

- Financial Statements: Ensure that your balance sheets, income statements, and cash flow statements are complete and accurate.

- Tax Records: Double-check your tax filings for any discrepancies or missing documentation.

- Invoices and Receipts: Keep a record of all invoices and receipts related to your business transactions.

- Contracts and Agreements: Ensure that all business contracts, leases, and agreements are accessible and well-documented.

3. Review Internal Processes and Controls

A significant portion of the audit process will focus on evaluating your internal controls and operational processes. The purpose of this review is to ensure that your business operates efficiently, complies with regulations, and is protected from risks such as fraud or errors.

- Segregation of Duties: Ensure that no one individual has control over all aspects of a particular transaction (e.g., both issuing invoices and processing payments). This is critical for preventing fraud.

- Record-Keeping: Accurate and complete documentation is essential. Ensure that all key documents are readily available and up to date.

- IT Systems and Security: Auditors will often assess the security of your IT systems, especially if sensitive data is involved. Ensure that your data protection measures are in place and that your cybersecurity protocols are robust.

4. Identify Potential Areas of Risk or Non-Compliance

It’s important to conduct a self-assessment of potential risks or areas where your business may not be fully compliant with laws and regulations. This proactive approach helps you identify problems before the auditor flags them.

- Regulatory Changes: Keep track of any changes in legislation or industry standards that may affect your business operations.

- Compliance Gaps: Identify any areas where your business might be non-compliant, such as labor laws, environmental regulations, or financial reporting requirements.

Reviewing financial statements as part of a full-scale business audit

- Internal Control Weaknesses: Look for potential weaknesses in your internal controls, such as inadequate segregation of duties or missing documentation.

Business team performing a comprehensive audit to enhance business performance

5. Work Closely with the Auditor

Effective communication with the auditor can streamline the audit process and ensure that any issues are addressed promptly. Here are some best practices for collaborating with your auditor:

- Be Transparent: Provide the auditor with all the necessary documentation and be transparent about any potential issues you’ve identified.

- Ask Questions: Don’t hesitate to ask your auditor questions if you’re unclear about certain processes or expectations.

- Provide Access to Key Staff: Ensure that the auditor has access to the relevant employees who can provide additional information or answer questions related to specific areas of the audit.

6. Create a Timeline for Preparation

An audit can be time-consuming, so it’s important to set a timeline for your preparation. Start preparing well in advance of the audit date, ensuring you have enough time to organize records, assess internal processes, and address any potential issues. A timeline will also help keep the process on track and ensure that everything is ready for the auditor when they arrive.

7. Conduct a Mock Audit

If time permits, consider conducting a “mock audit” to assess how prepared your business is for the actual audit. This internal review can identify weaknesses in your preparation and provide an opportunity to address any issues before the formal audit begins.

A mock audit can include a review of financial records, internal processes, compliance, and any other relevant areas. This will help you familiarize your team with the audit process and ensure that everything is in order.

Conclusion: Ensuring a Successful Audit Process

Proper preparation for a business audit can make the entire process smoother and less stressful. By organizing your financial and operational records, reviewing internal controls, and identifying potential areas of non-compliance, you can set your business up for a successful audit.

Remember, audits are an essential tool for improving business performance, ensuring compliance, and identifying areas for improvement. Taking the time to prepare thoroughly will pay off in the long run, leading to a more efficient and compliant business.